Skip to timeline

- ASX 200: +0.6% to 7,968 points (final)

- Australian dollar: +0.03% at 63.61 US cents

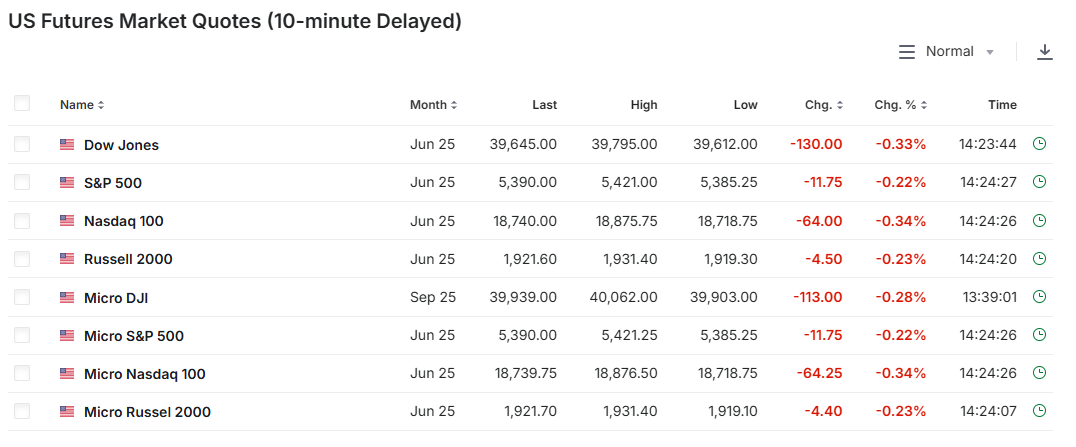

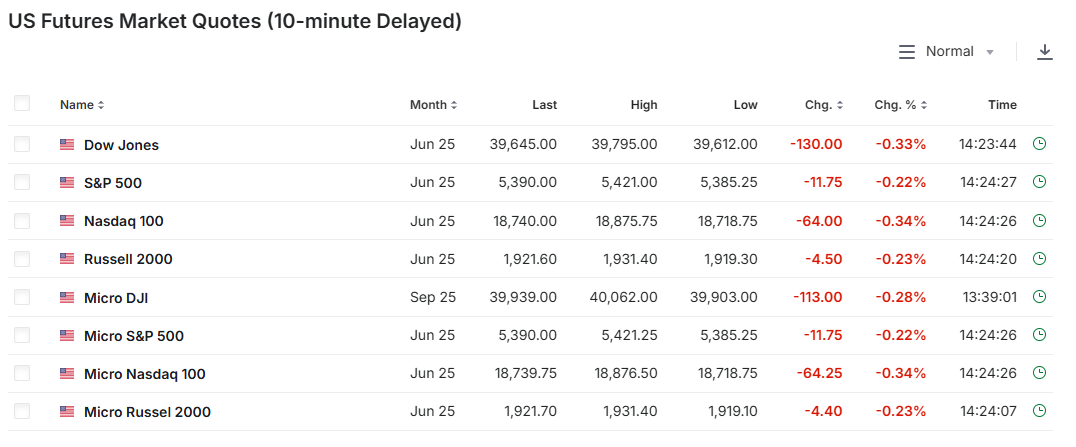

- S&P 500: +1.7% to 5,375 points

- Nasdaq: +2.5% to 16,708 points

- FTSE: +0.9% to 8,403 points

- EuroStoxx 600: +1.8% to 516 points

- Spot gold: +0.99% to $US3,320/ounce

- Brent crude: -2.45% at US$67.98/barrel

- Iron ore: $US100.09/tonne

- Bitcoin: -1.11% to $US92,639

- Beginning October 14, 2025, a fee will be imposed on the entry of a Chinese-owned or operated vessel into a US port at a rate of $50 per net ton. The rate will be increased beginning in April 2026, plateauing at $140 per net ton in April 2028.

- Beginning October 14, 2025, a fee will be imposed on the entry of a Chinese-built vessel into a US port at a rate of $18 per net ton. The rate will be increased beginning in April 2026, plateauing at $33 per net ton in April 2028.

- The fees on Chinese-built vessels and foreign-built vehicle carriers, and restrictions on LNG exports, will be suspended for up to three years if the vessel owner orders and takes delivery of a US-built vessel of equivalent or greater capacity. This suspension does not apply to Chinese-owned or leased vessels.

- ASX 200: +0.57% to 7,965 points (live values below)

- Australian dollar: -0.03% at 63.55 US cents

- S&P 500: +1.7% to 5,375 points

- Nasdaq: +2.5% to 16,708 points

- FTSE: +0.9% to 8,403 points

- EuroStoxx 600: +1.8% to 516 points

- Spot gold: +1.09% to $US3,323/ounce

- Brent crude: -2.45% at US$67.98/barrel

- Iron ore: $US100.09/tonne

- Bitcoin: -0.73% to $US92,998

- How useful are 'leading' labour market indicators at forecasting the unemployment rate?

- Monetary policy transmission through the lens of the RBA's models

- Bank funding in 2024